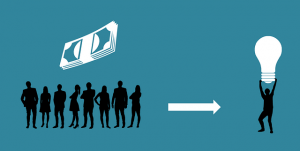

Have you heard of mezzanine financing? It’s a unique form of business financing that combines the properties of debt and equity financing. Real estate companies, for example, often use mezzanine financing to secure money for the purchase of new properties. Other businesses use mezzanine financing as well. Regardless of your business, though, you might be wondering what benefits mezzanine financing offers.

What Are the Benefits of Mezzanine Financing?

The Basics of Mezzanine Financing

Also known as junior capital financing, mezzanine financing is a form of business financing in which the lender has the right to convert the borrower’s debt to equity. It’s considered a hybrid financing method because it uses both debt and equity. If the borrower fails to repay the loan, the lender can convert his or her debt to equity. In other words, the lender will take ownership of the borrower’s assets.

Also known as junior capital financing, mezzanine financing is a form of business financing in which the lender has the right to convert the borrower’s debt to equity. It’s considered a hybrid financing method because it uses both debt and equity. If the borrower fails to repay the loan, the lender can convert his or her debt to equity. In other words, the lender will take ownership of the borrower’s assets.

Fast

You can typically obtain a mezzanine loan more quickly than a traditional loan. Traditional loans, such as Small Business Administration (SBA) loans, can take over 90 days to obtain. In comparison, you can often obtain a mezzanine loan in as little as a few weeks. If your business needs additional capital to covert immediate growth-related projects, a mezzanine loan may be the right solution.

Easy

The application process for mezzanine loans is also more forgiving than that of traditional loans. Mezzanine loans are offered by investors and private lenders. And since they are backed by equity, they have minimal requirements. You don’t need a stellar credit score. As long as your business has equity to offer, you can probably obtain a mezzanine loan. Mezzanine loans are both fast and easy to obtain, making them a popular way to finance businesses.

Tax-Deductible Interest

While you’ll still have to pay interest on a mezzanine loan, you can deduct those costs from your business’s taxes. Interest on mezzanine loans is tax deductible. Whether you pay $500 or $50,000 in annual interest on a mezzanine loan, you can deduct it from your business’s taxes.

While you’ll still have to pay interest on a mezzanine loan, you can deduct those costs from your business’s taxes. Interest on mezzanine loans is tax deductible. Whether you pay $500 or $50,000 in annual interest on a mezzanine loan, you can deduct it from your business’s taxes.

Retain Control

You’ll retain control of your business with a mezzanine loan. This hybrid financing method only gives the lender the right to convert your debt to equity — but only if you fail to meet the repayment obligations. With that said, most mezzanine loans are structured in a way that prevents the lender from taking control. With a mezzanine loan, you’ll retain control of your business.

This article was brought to you by�Intrepid Private Capital�Group�� A Global Financial Services Company. For more information on startup and business funding, or to complete a funding application, please visit our�website.

+ There are no comments

Add yours