Still trying to wrap your head around the concept of venture capital vs�seed capital? While both of these�types of business capital are used to fund new ventures, there are some key differences between them which�shouldn’t go unnoticed. Today, we’re going to take a closer look at the difference between an�angel investor vs venture capitalist.

Angel Investor vs Venture Capitalist Basics

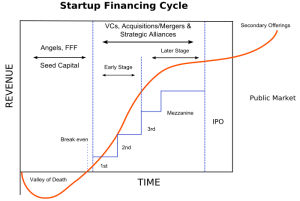

Seed capital�lives up its namesake in the sense that it’s the capital needed to “seed” a business. Seed funding�may come from various sources such as family members, friends, banks, or angel investors. More often than not, this�is the very first source of funding�that an entrepreneur receives for his or her idea. Therefore, it’s a critical element in launching a successful startup business.

Venture capital, on the other hand, refers to capital that’s required for larger businesses. It is typically sourced from venture capitalists who raise the funds from their own internal pools of investors. The purpose of investing venture capital into a business is to yield a positive return on the venture capitalists’ investment.

What is Seed Capital?

Another key difference between venture capital and seed capital is the total amount of funding invested. With seed capital, typical investments usually range in the tens of thousands to hundreds of thousands of dollars. Venture capital investments often range into�millions of dollars. So, if you are an entrepreneur looking to fund a�new idea with seed money, expect to receive smaller investments when compared to venture capital.

Risks

Of course, risk level is another striking difference between venture capital and seed capital. Because seed money�is invested during the early stages of a startup, there’s greater risk involved on behalf of the investors. Many entrepreneurs seek this type of funding�without any proof of revenue, in which case the investor must decide if it�is�worth the risk.

With venture capital, the entrepreneur may already have at least some sales, mitigating the risk for investors. If an investor can see that an entrepreneur is generating revenue,�even if it’s not profit, they�may feel more comfortable investing money.

Hopefully, this will give you a better understanding of the differences between�these types of business capital.

This article was brought to you by Intrepid Private Capital Group � A Global Financial Services Company. For more information on startup and business funding, please visit our�website.

+ There are no comments

Add yours